Financial management covers all the aspects of management mainly including income, expenditure, cash flow, profitability, and capital management while establishing close links with the other areas of management within the company. It is possible for micro, small, and medium enterprises (MSME) to be categorized as for how the financial information is well established or as for the involvement of those links mentioned above. But the term “financial information” is not specifically referring to formatted and formal financial tables but any kind of recording system on financial affairs is welcomed in an MSME. The key fact is to have the power of control on the financial aspect of the company.

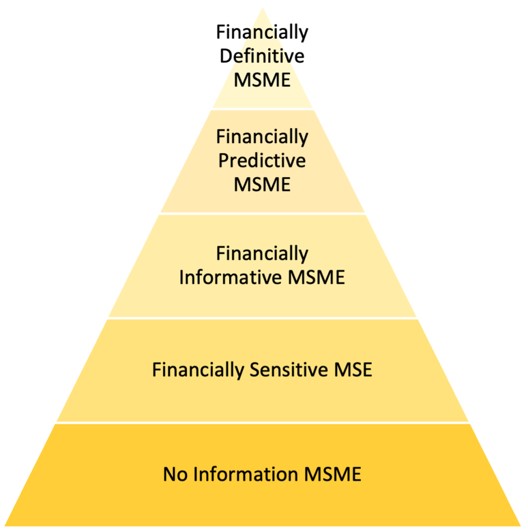

There is a pyramid of hierarchy on the above-mentioned categorical approach on financial management system and at the lowest level of the pyramid is “no information MSME”. There are some fundamental financial figures that any kind of business must be aware and keep it under the control. i.e., income and expenditures. The state of being not aware of the income and expenditures of the business is referred as “no information MSME”. It is simply defined the performance of the business as; if there is money in the pocket of the owner the business is running well.

The second level of the pyramid is “financially sensitive MSME”. The companies of this level are aware of the income and expenditures, but they have continuously cash-flow problems. The business owner knows there is a money to come and money to go but not know exactly when. This is a typical cause of cash flow problems in any given business. That’s why the companies at this level needs foreign funding for their business and the bank lending is the most practical way of getting of it. If the businesses of this level had a better know how on how to manage the cash flow, their need for bank loans would be less and their profitability would be higher.

The third level the pyramid is “financially informative MSME”. This type of business knows both income/expenditure and estimated cash flow of the company. The business in this question keeps the track records of both income and expenditures regularly. And if asked, can easily give the income and expenditure figures of the company. In addition to those figures, it is also possible, in this business, to know the payment and collection program of the transactions currently realized. In practical life you can have the estimated cash flow based on realized procurements and sales and fixed costs. This helps the company to balance the cash going for the payments with the cash coming from the collections and put necessary response prior to any cash flow crisis.

The fourth level of the pyramid is “financially predictive MSME”. This is a one-step advanced version of the “financially informative MSME” by adding some predictions on the cash flow side. These predictions are only possible if any business can have a reliable sales plan incorporated with the related cost plan. Then the business, in addition to cash flow plan based on realized transactions, is able to have cash flow estimations for the upcoming sales estimations and the related cost estimations. The business in question can make a sales plan at the beginning of each year with the addition of cost estimations directly related to the sales and expenditure estimations for indirect costs. These plans are regularly (or promptly in case of unexpected developments) updated as necessary. Simply you may have cash flow estimates of this business including the estimations of non-realized sales and expenditures.

The fifth level of the pyramid is “financially definitive MSME”. This is the state-of-the-art level in financial management terms having all the aspects of the prior levels of the pyramid but adding profitability and strategic management aspects. The profit is one of the main piers of the financial management of this type of business and there is a target set for profit at the end of the year. It is followed up and taken care during the daily operations of the company. But it is not the only concern to track the profit but also the profitability. Profitability is the ratio of the profit to the revenue while profit is just and absolute value of how much money is earned out of the business. One of the expected management issues of this type of business is the management of the profitability. The business most probably has plans to increase the level of the profitability (at least to keep the current level) by interfering the other functions of the business. This is the strategic level of financial management, and it is the responsibility of the owner (may be with a key manager) since there will be some outcomes as for strengthening the product line (both production/trade/service companies), diversifying the markets and customer structure, decreasing the cost and expenditures, etc.

There is another issue in financial management for the MSMEs which is effective investment management but, it is the subject of another article.